How to Credit a Tenant from the Property Management Company

This article will walk you through the steps on how to credit a Tenant from the Property Management Company.

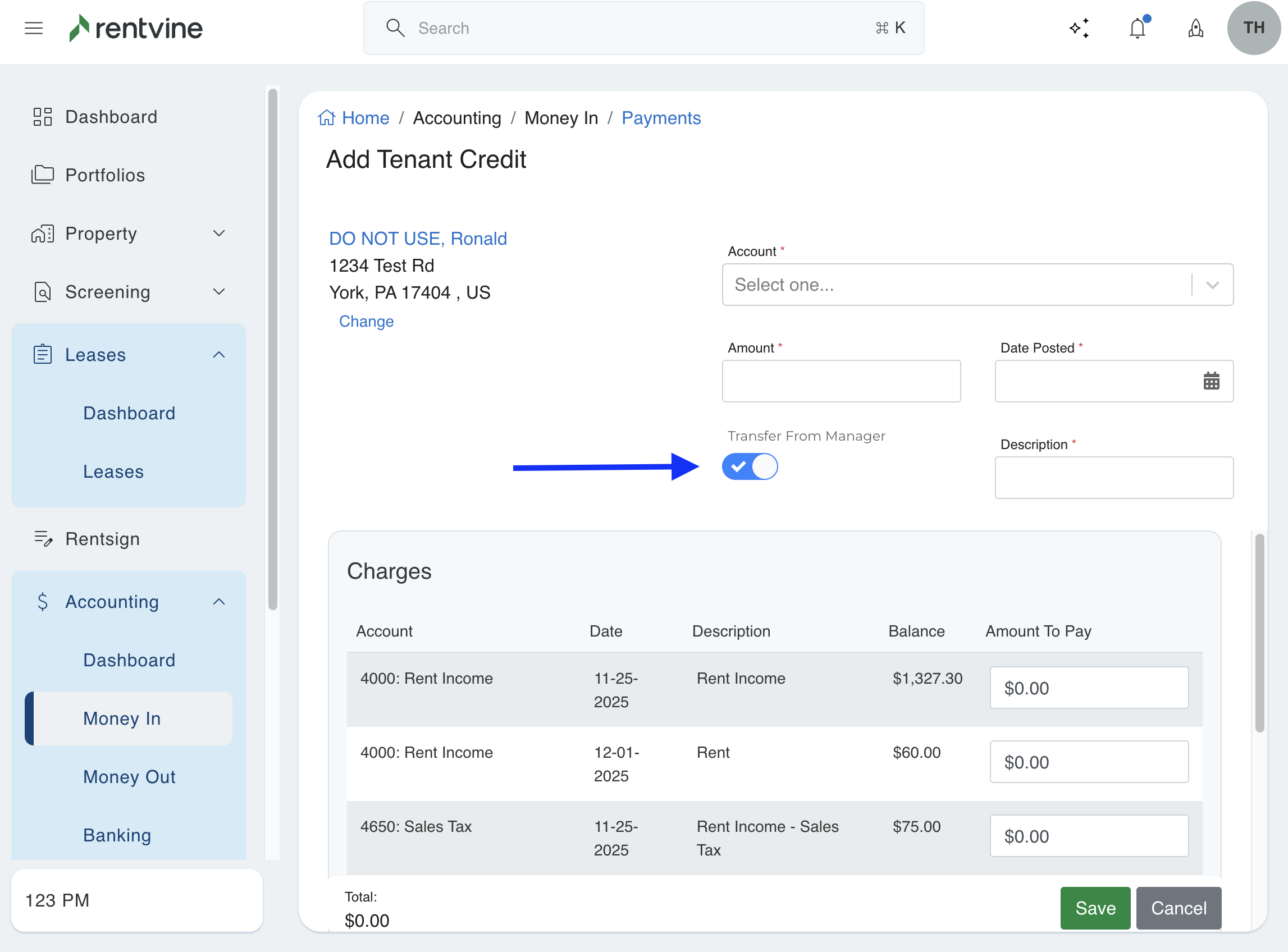

- If you are in Manager ledger mode, the credit can be given from the property management company. To do this, you would use the "Transfer From Manager" toggle on the form. This toggle is only available in manager ledger mode and allows you to transfer a credit from the management company's ledger to the tenant's ledger.

- If you are in Bill Management Fee mode, there are two ways to credit a tenant from the management company.

- Scenario 1 does NOT require the Property Manager to fund the Trust bank account from an Outside source (i.e., Corporate Bank Account).

- Scenario 2 does require the Trust bank account to be funded from an Outside source (i.e., Corporate Bank Account).

Scenario 1:

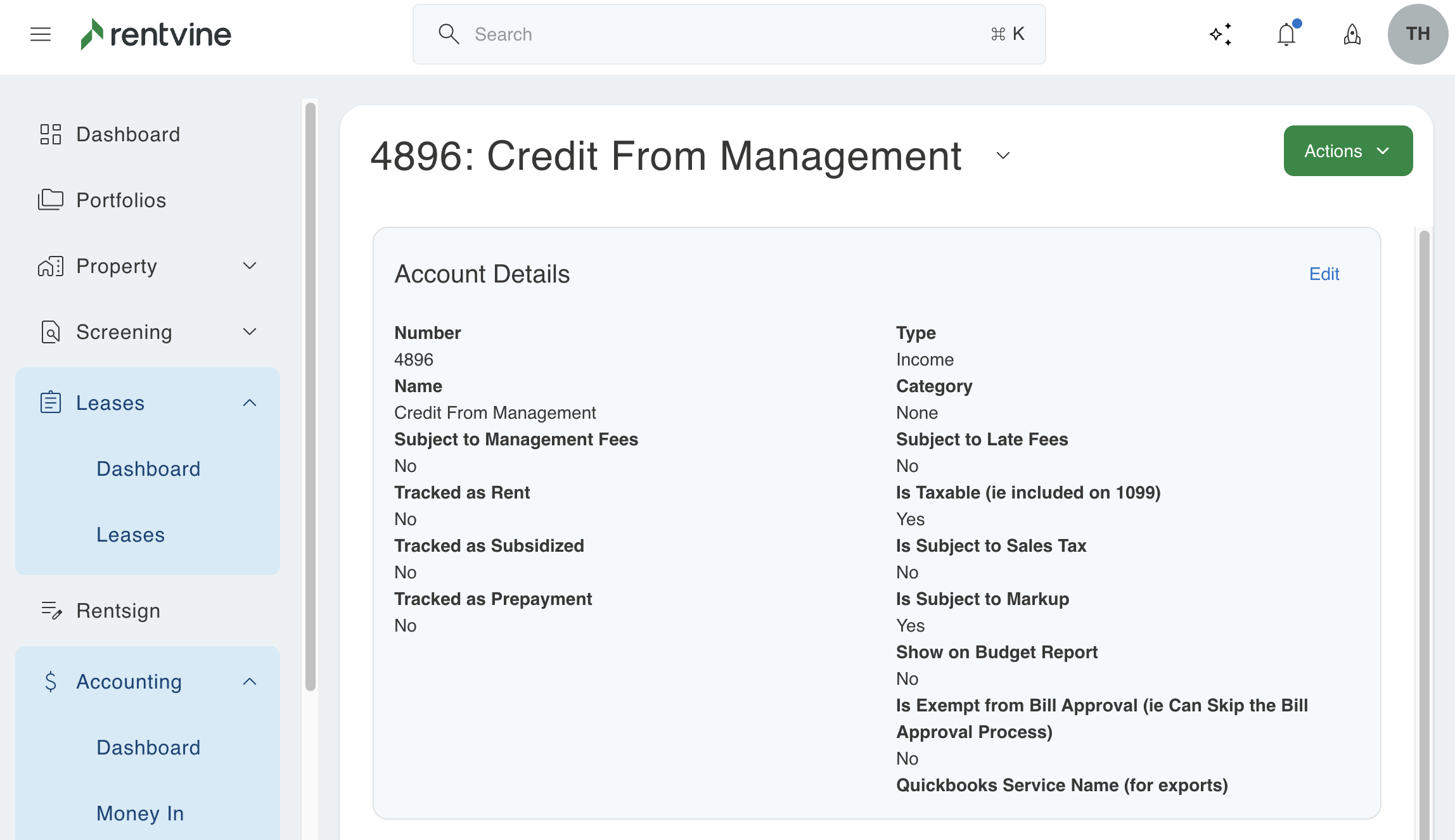

- First, you'll create a new income type C.O.A. named "Credit from Management Company."

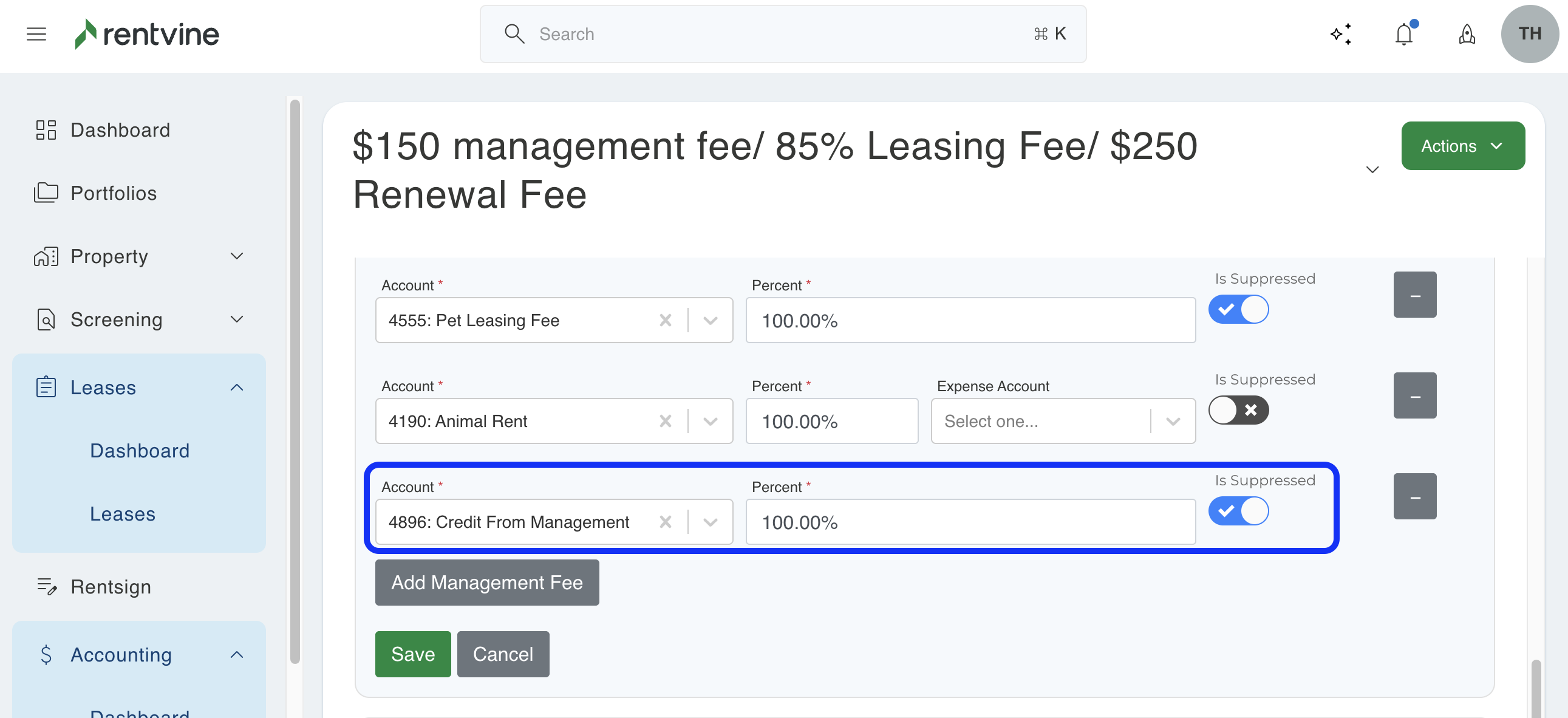

Then, add this C.O.A to the Management fees setting of the property as an Additional

Management Fee.

Make sure to have this fee 100% suppressed.

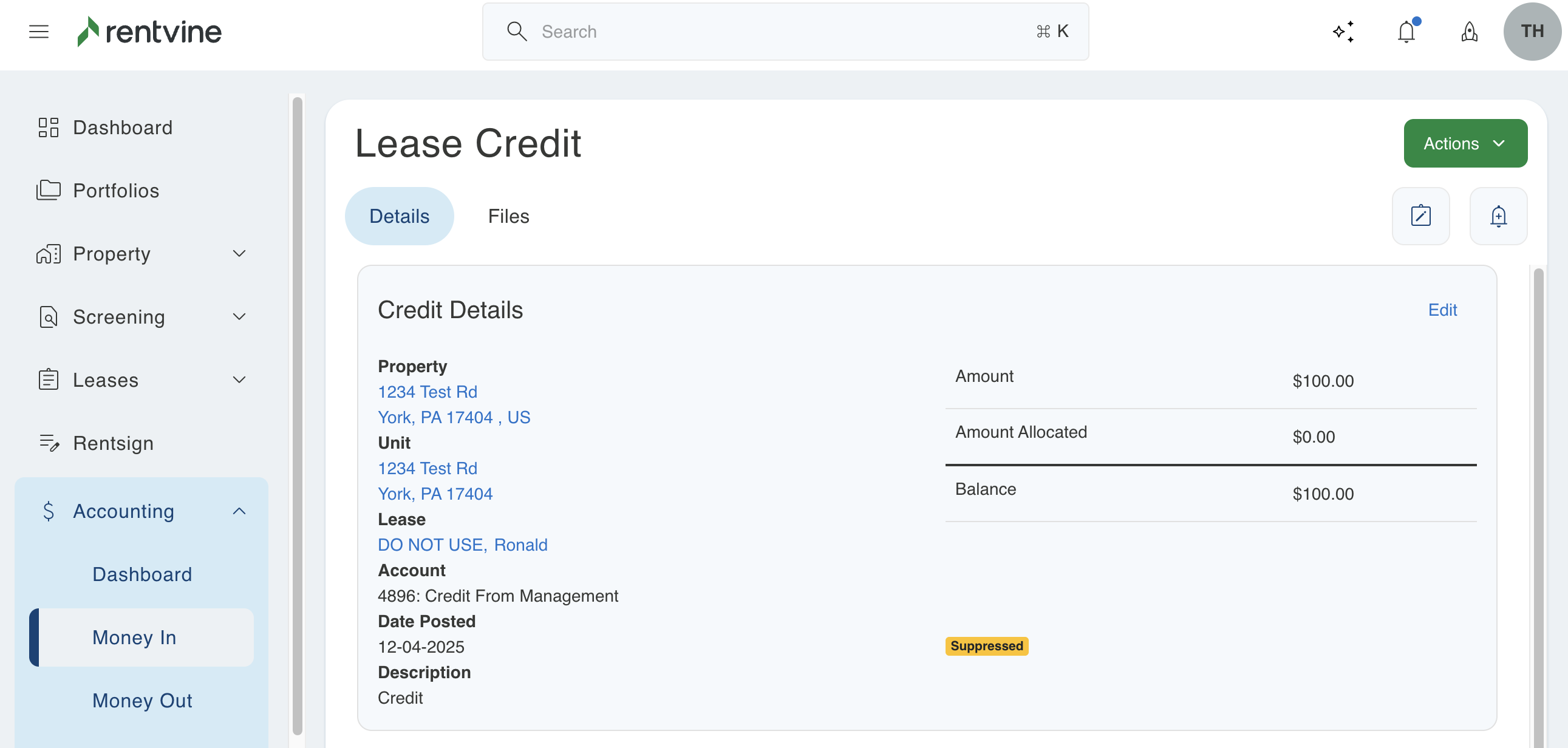

- Next, add a Lease Credit to the lease using that new suppressed income C.O.A.

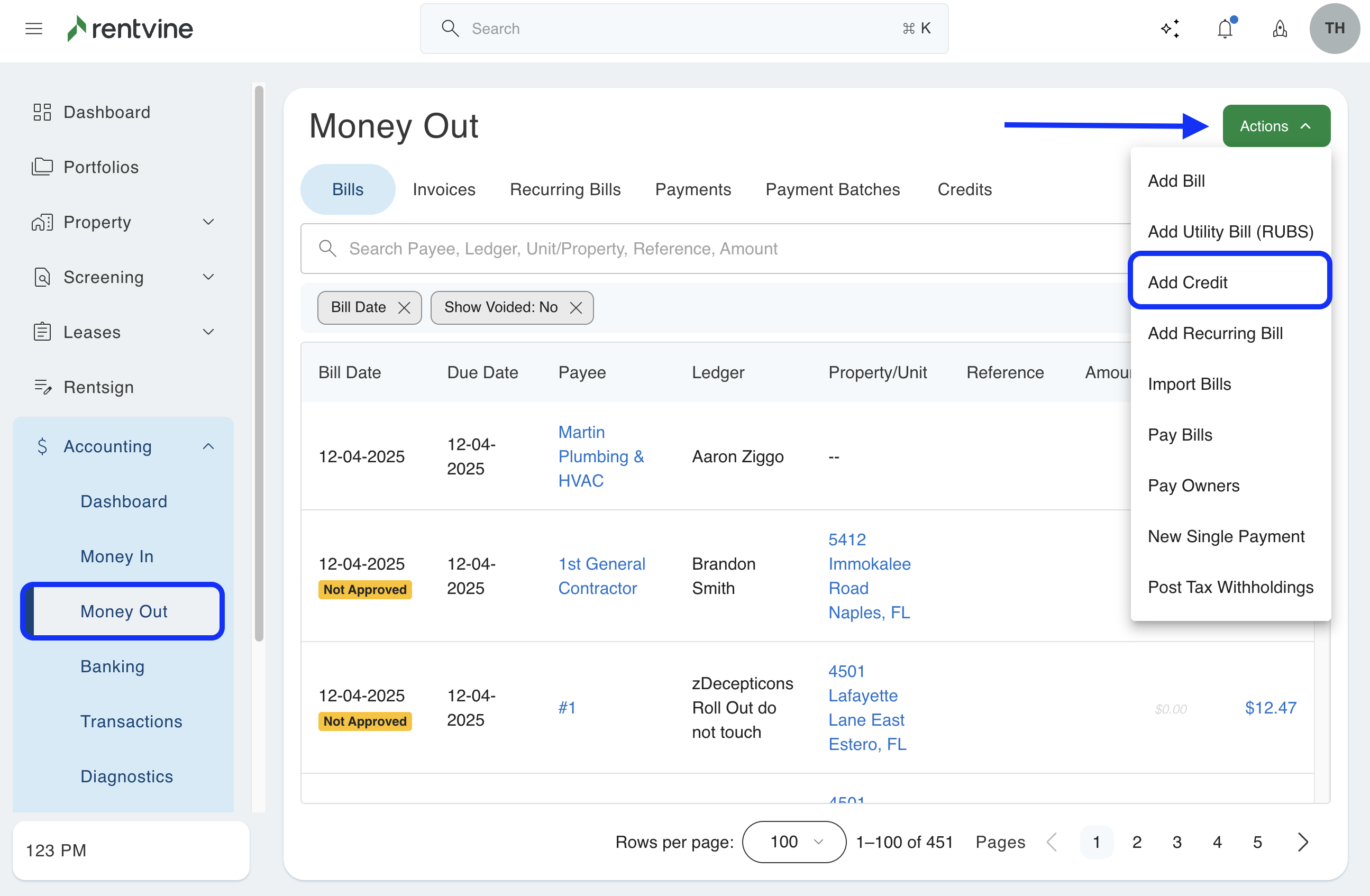

- Once the lease credit is added and applied to a charge, you will add a Bill/Vendor Credit. Click on the Accounting tab> Money Out> Actions> Add Credit.

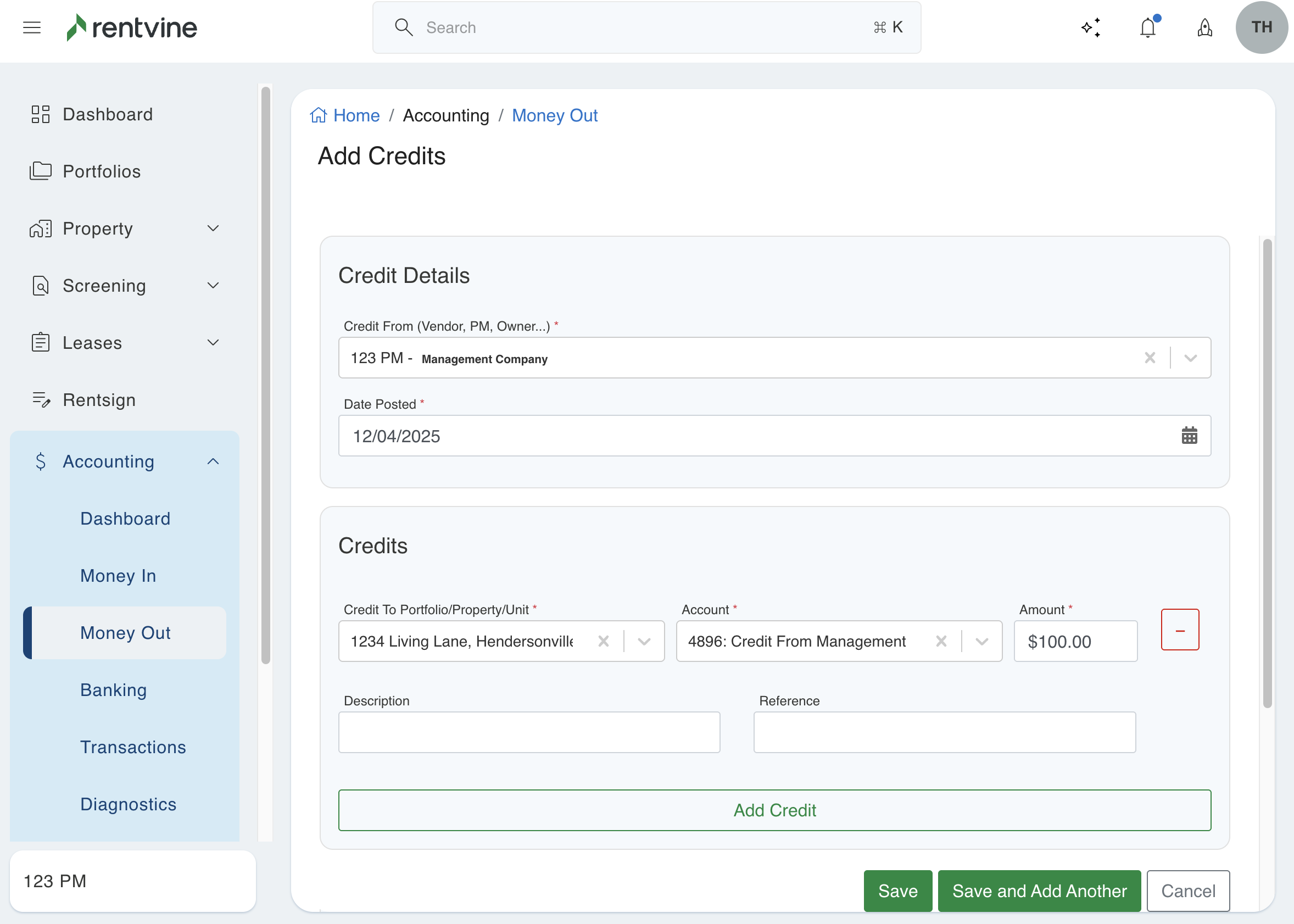

- Below is an example of how the credit should be added:

Please note the GL account used in the credit above is the same GL account used to record the lease credit (this is the suppressed C.O.A. we created). Also, the Payee must be the Management Company, and the Payer must be the Unit Address (as shown above).

- The last step is to apply that vendor credit (view the applying credits section of this article) to an unpaid bill due to the property management company from the owner(portfolio) of the unit. Once that is completed, you've credited the tenant without affecting the cash balance of the owner(portfolio).

Scenario 2:

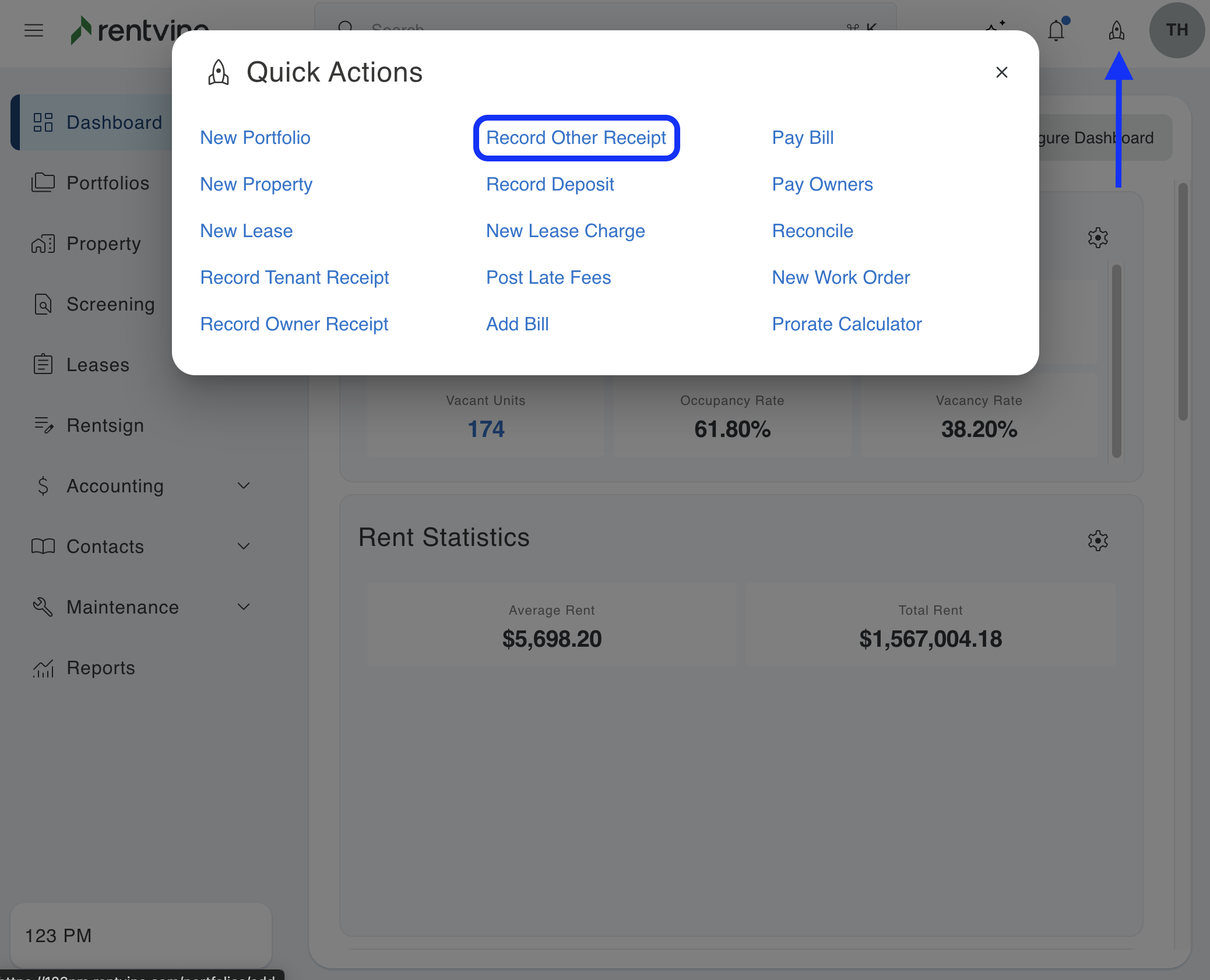

- Record an Other Receipt (Quick Actions>Record Other Receipt) to the Portfolio that the lease is associated with. When you add the Other Receipt, make sure to select the unit address and NOT the portfolio. Be sure to select a suppressed income account to suppress the transaction from the owner.

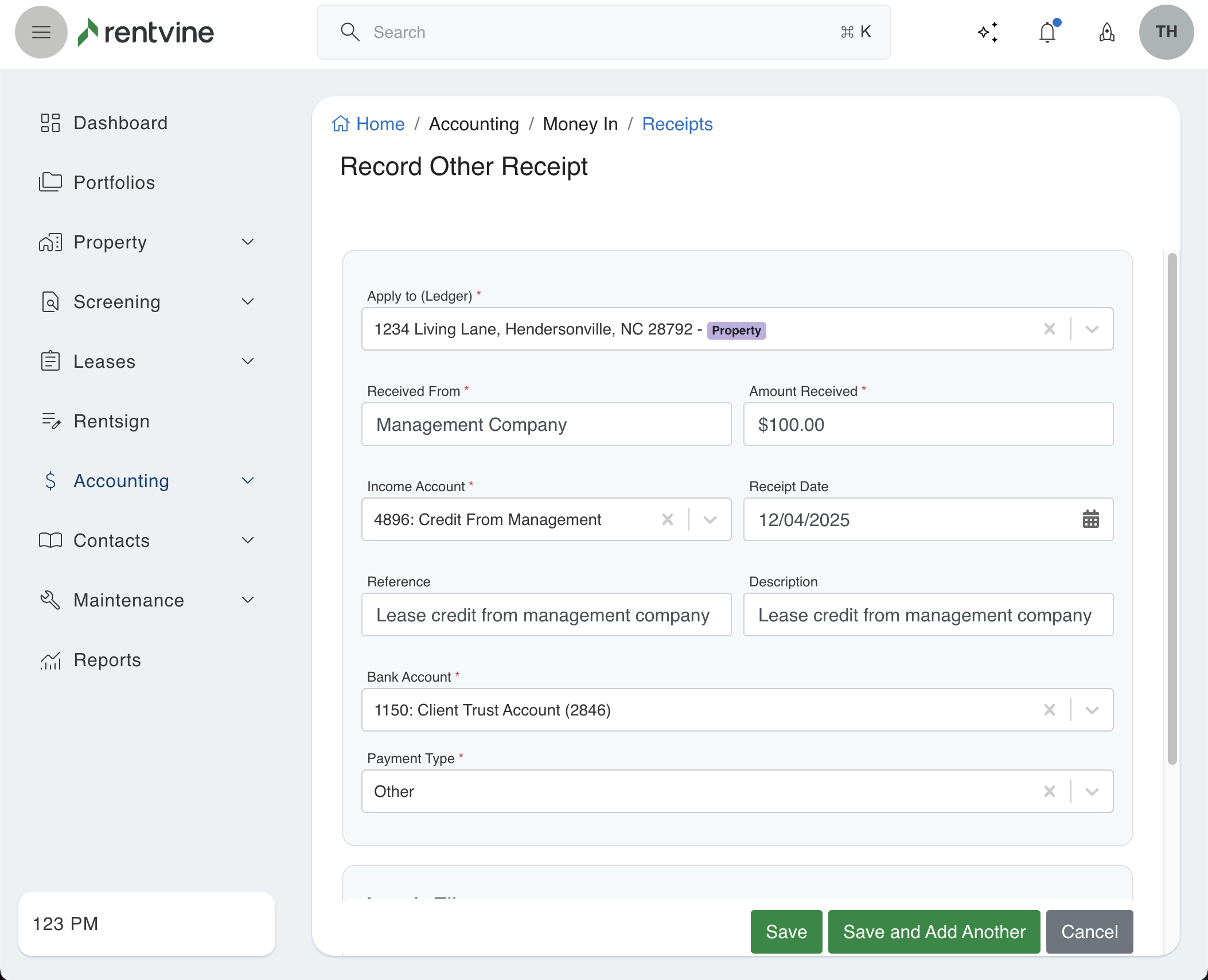

- The Other Receipt should look something along the lines of the image below.

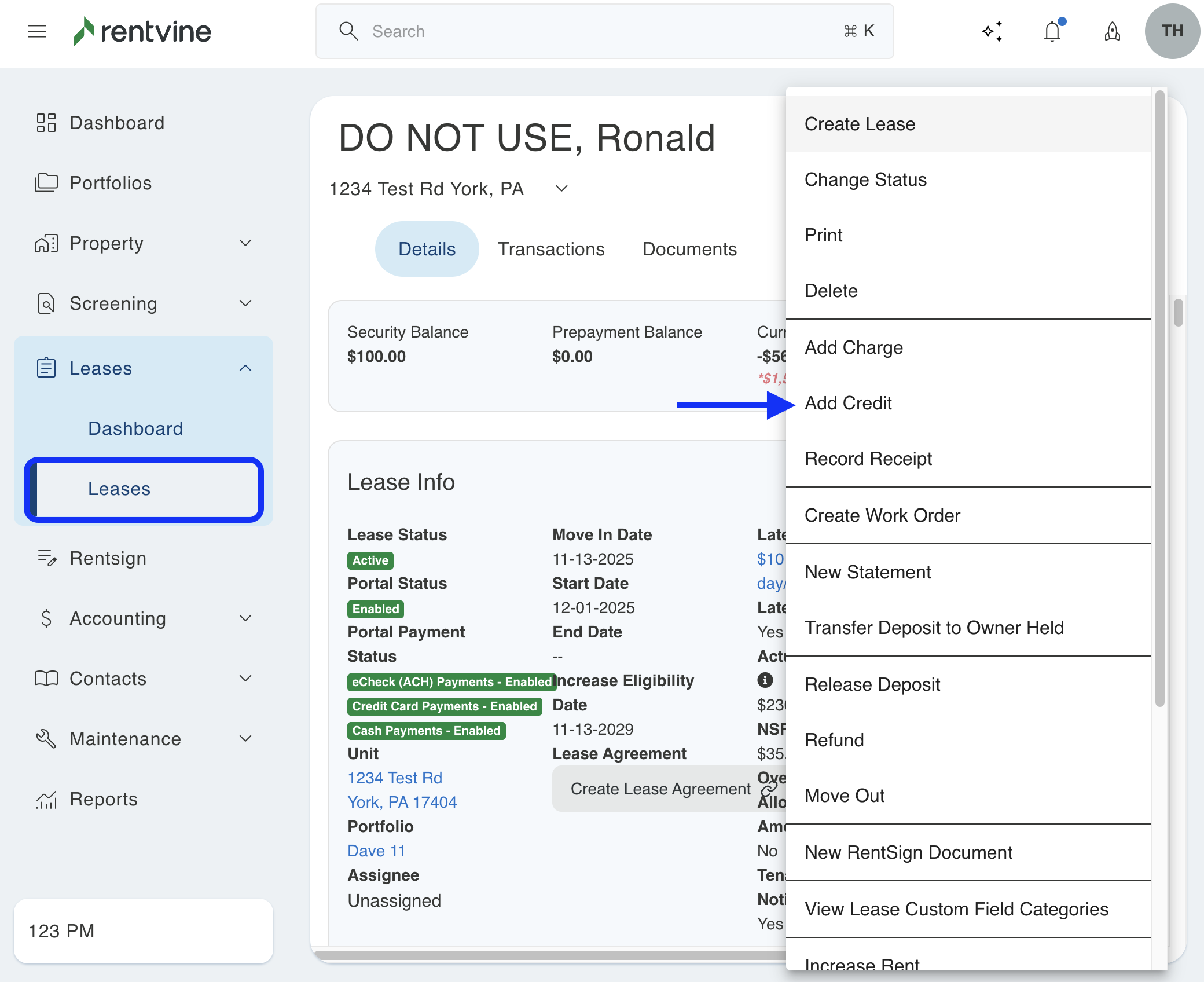

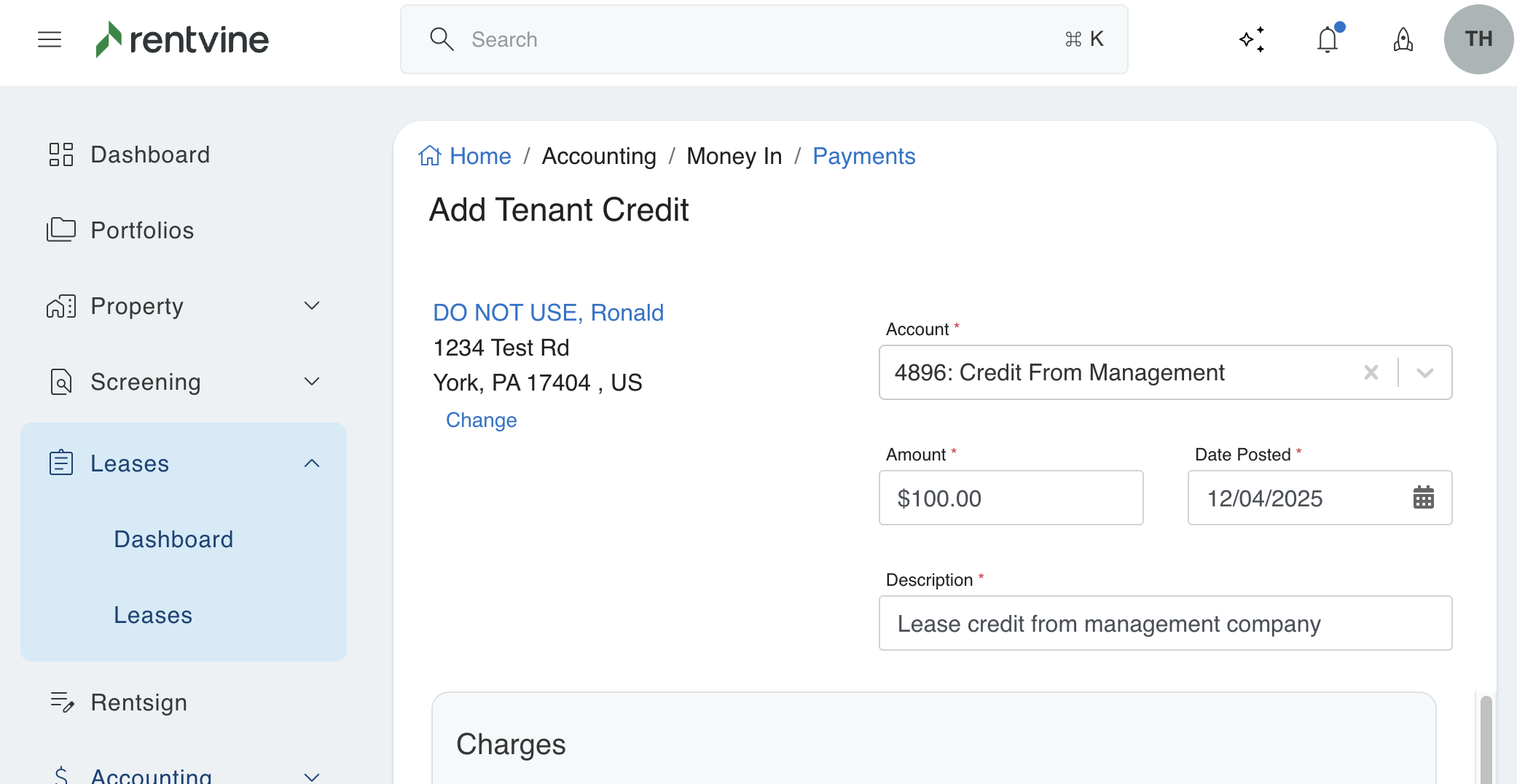

- Next, navigate to the lease you want to credit. Click the Green Actions Button and then click Add Credit.

The Lease Credit should also be the same dollar amount as the Other Receipt; if not, the credit will not be fully suppressed.

The final step is to transfer funds from an external bank account (typically your business or corporate bank account) to the trust account in order to cover the amount of the credit and other payments you recorded.

This step ensures the accuracy and stability of the Trust Bank account balance in real life.