How to Submit Corrections for 1099's

This article will walk you through the steps on how to create a correction and download the FIRE File.

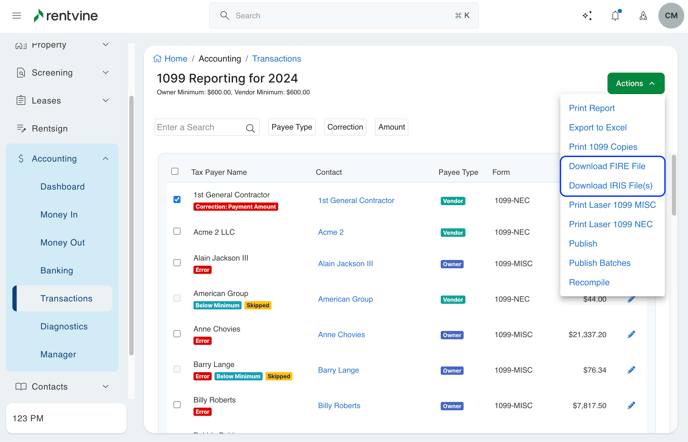

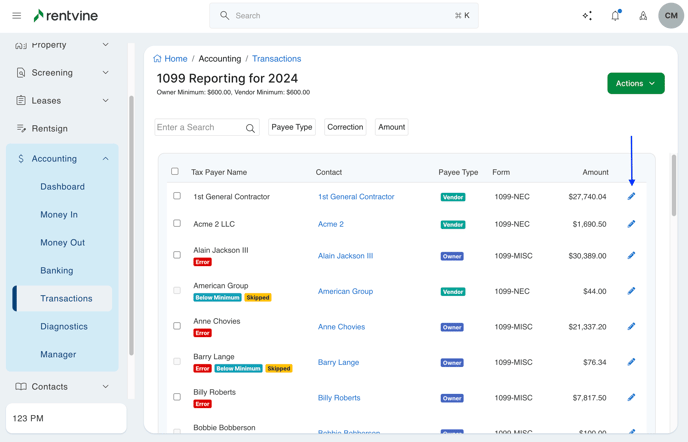

Under Tax Reporting, you will see a list of Payees for the current reporting year.

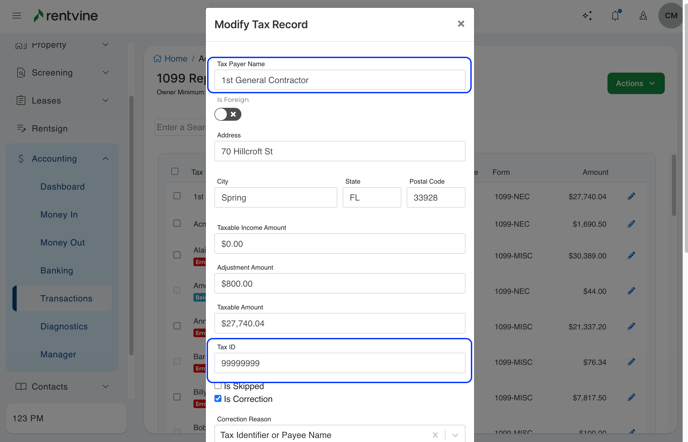

Select the pencil icon associated with the contact that needs a correction.

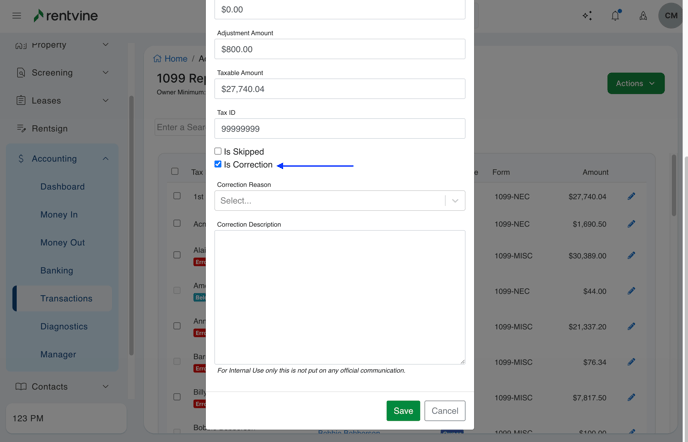

Next, the Modify Tax Record screen will appear. At the bottom of the menu, you will check off "Is Correction."

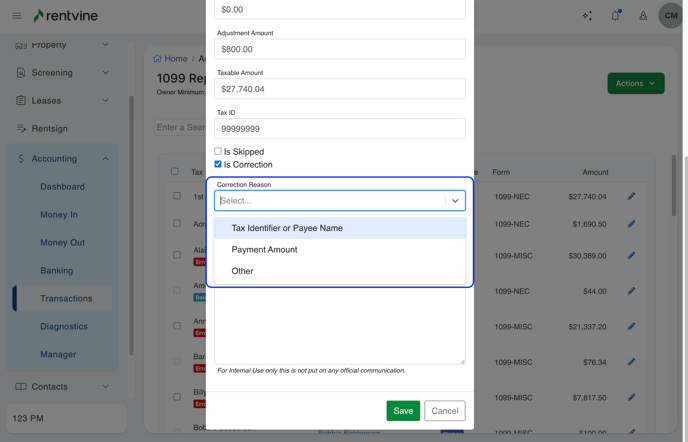

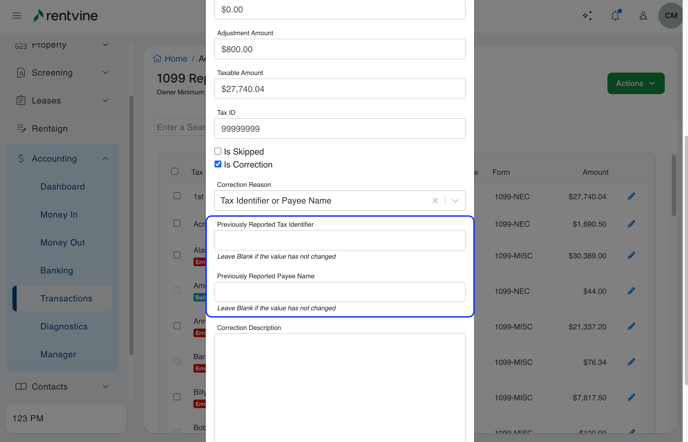

You will select a Correction Reason:

When the Tax Identifier or Payee Name is selected, you will need to enter the previously recorded information under the Correction Reason field:

Once the information above is completed, please update the Payee name and Tax-ID with the new corrections that will be reported to the IRS in the fields above the Correction Reason drop-down.

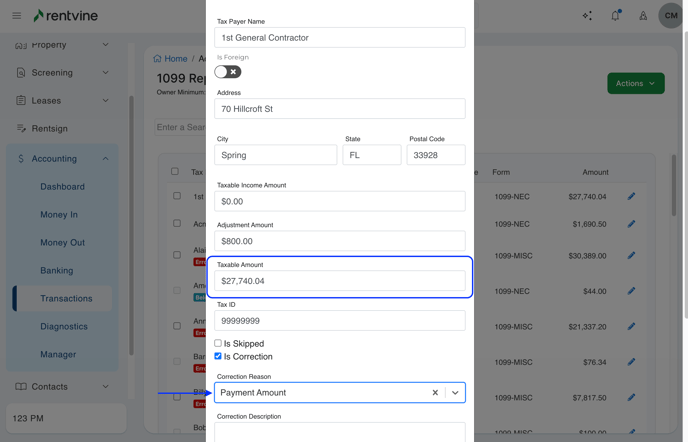

If the Correction Reason is "Payment Amount." Please update the Taxable Amount and click Save.

At this time, please do not select "Other" as your Correction Reason; this option will not update a tax record.

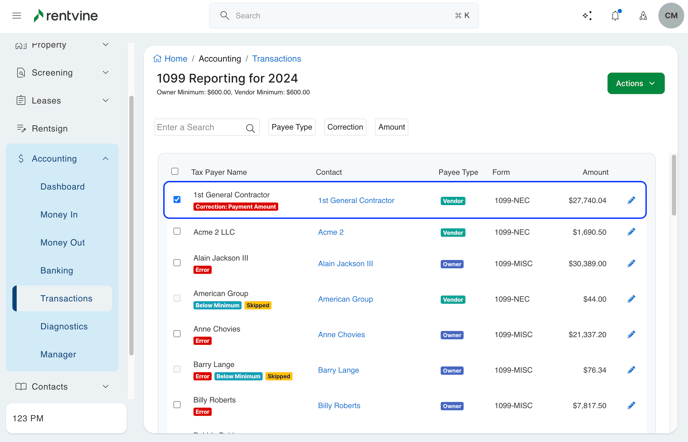

Once you've made all the corrections to your payees, select the payees you have made changes to.

Lastly, select Actions>Download FIRE File or Download IRIS File. This will generate a FIRE file or an IRIS file that can be used to upload to the IRS. It will download to your device locally.