How to Generate a Positive Pay Report

Positive Pay is a fraud prevention service offered by banks to help protect their customers from check or electronic transactions fraud. It is commonly used by businesses that issue a large number of checks or electronic transactions

With Positive Pay, a business provides its bank with a list of authorized checks or electronic transactions it has issued. When a check or electronic transaction is presented for payment at the bank, the bank compares the details of the check or electronic transaction, such as the check number, date, and amount, against the information in the business's authorized list. If the details match, the check or electronic transaction is cleared, and the payment is processed as usual.

However, if there is a mismatch or discrepancy between the presented check or electronic transaction and the authorized list, the bank will not clear the check or electronic transaction for payment. Instead, the bank will notify the business of the exception or discrepancy. The business can then review the details and decide whether to approve or reject the payment. This process helps prevent fraudulent or unauthorized checks or electronic transactions from being paid.

Positive Pay adds an extra layer of security to the check or electronic payment process and reduces the risk of financial loss due to check fraud. It is particularly effective in detecting counterfeit checks, altered checks, checks with forged signatures, or electronic payment fraud.

It's worth noting that the exact features and procedures of Positive Pay may vary depending on the bank and the specific implementation. If you are interested in using Positive Pay for your business, it is recommended to contact your bank for more details on how they offer and administer the service.

Here are the steps you can follow to generate a positive pay report that can be provided to your bank:

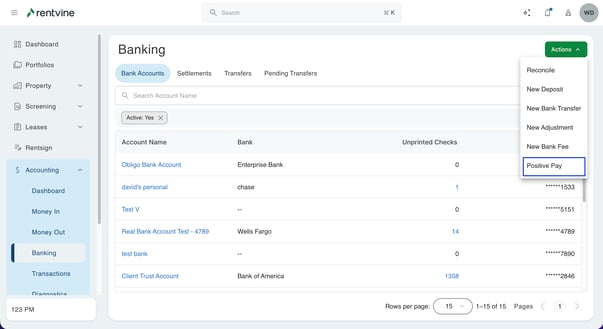

- From the left navigation menu, click on Accounting, then Banking.

- Click on the Actions button and select Positive Pay.

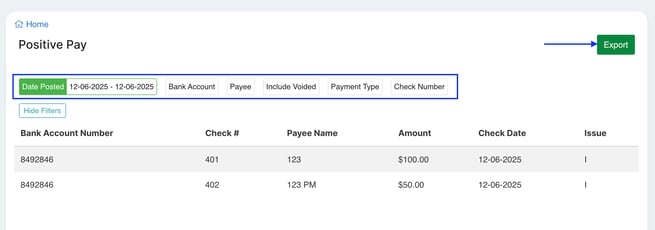

- The default setting in Rentvine generates a positive pay report with today's date for all bank accounts. However, you can customize the report by adjusting the filters located at the top of the page to suit your preferences. After reviewing and being content with the generated report, you can export it to a CSV file by clicking on the Export button at the top of the page.